We crunched the numbers

On last year vs this year on a similar home in a similar area to give you all a better perspective on affordability then vs now. While there does seem to be a “magic” number that helps put things at the Buyers advantage, every scenario, price point and property may yield different results. In some cases, a higher interest rate paired with a lower price point actually works out to be more affordable on a month to month basis (and with less down payment. The numbers don’t always add up though.

To help sort this out for our clients, we looked at 2 different scenarios. In the first; buyers were at an advantage with less down payment and less monthly payments than a year ago with lower interest rates. In the second example, it was actually a higher monthly payment to carry the mortgage at current rates… Curious to see which one was the winner? Read on, see the image below, or watch the video.

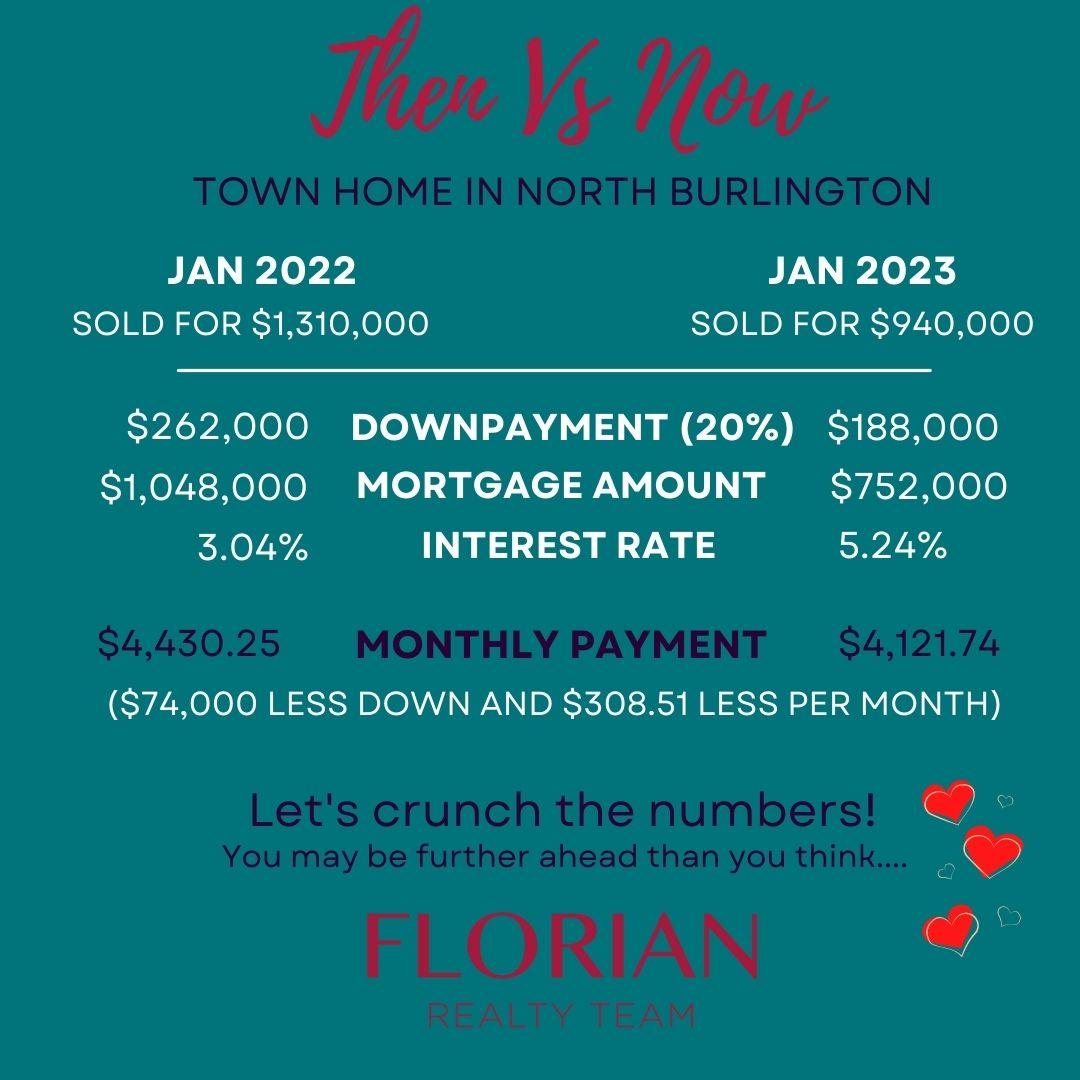

Scenario One: Then vs. Now……Townhome in North Burlington

January 2022 sells for $1,310,000 with a 3.04% interest rate. Monthly Payment: $4,430.25

January 2023 sells for $940,000 with an interest rate of 5.24%. Monthly Payment: $4,121.74

In this scenario, the buyer wins with 2nd sale with $308.51 less in monthly payments

*see below image for the breakdown… NB. we used same banks/mortgage types to be sure we were comparing apples to apples.

Scenario Two: Then vs. Now… Detached home in North Burlington

January 2022 Sells for $1,520,000 with a 3.04% interest rate … Monthly Payment: $5140.44

January 2023 Sells for $1,355,000 with 5.24% interest rate. … Monthly Payment $5941.45

In this scenario, the more recent sale resulted in over $801.01 more in monthly payments.

Is there a magic number?

While not every scenario is the same, and personal goals & financial situations of course play a role, we did the math on many different transactions and it would seem that there is a magic number (percentage drop in price from last year to this), that would make a purchase more worthwhile/affordable this year vs. last. We don’t want to paint an entire market with one brush stroke given that the numbers may vary for you personally, so rather than post what we believe to be the “magic number”, give us a call or send us an email if you’re curious and we’ll explain in more detail!

The Bottom Line:

Considering options for a move, first time home purchase or investment? Let’s help you get some clarity. There are so many ways to win in this market. If you’re holding onto a deposit amount from last years market, you may be even further ahead as your monthly payments will be even lower. Likewise, if your deposit wasn’t large enough to even get into the market last year, this may be your rare (and potentially small) window of opportunity! Give us a call today to see if the numbers work for you: hello@florianrealtyteam.ca