Jumping into an investment property whether you’re a first timer or a seasoned investor- can be an overwhelming process and there’s a lot to consider.

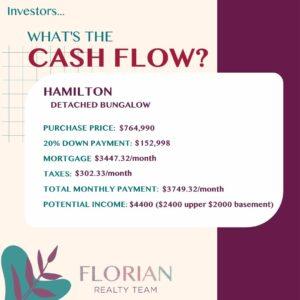

How much down payment will I need? What kind of rent will different properties in different areas be able to potentially achieve? But ultimately, and most importantly for some, once all the monthly expenses to hold the property are considered, cash flow is usually top of mind for people. In this market especially with rising interest rates, the question of whether or not an investment property will cash flow has become even more critical- and as we’ve always said in the past- one must remember that you marry the house and you only date the rate! So something that looks like it may only be just breaking even in todays’ market, (or even going slightly under monthly), may sometimes actually be a great investment depending on value and area. But guess what? Many properties are actually still seeing cash flow at current market interest rates. And you know what that means? Investors, now is your time to make sure you’ve got your homework done and are ready to jump. We sampled two properties in Burlington and Hamilton to give you two examples that would cash flow quite nicely in today’s market, but every property is unique and offers different pros and cons, so don’t go it on your own! If you’re considering options: let’s crunch the numbers for you and make sure you’re set up and ready to go with no surprises.

There are so many great opportunities in todays’ market and we’re happy to help guide you!